05 Jul vBOD – Virtual Board of Directors

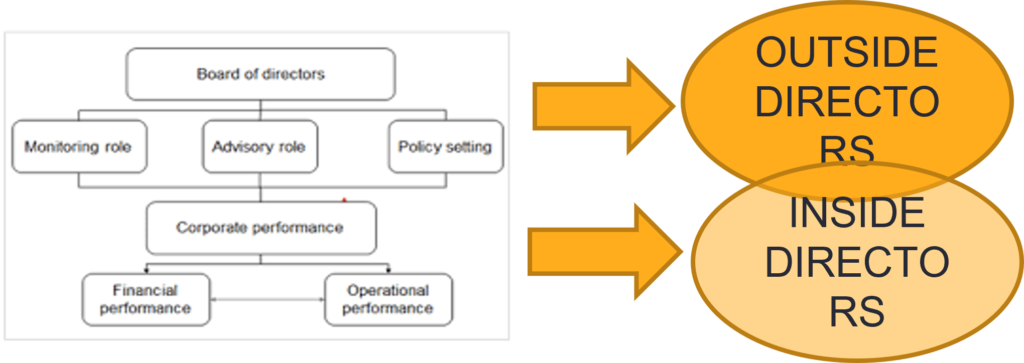

Roles and Responsibilities of the Board of Directors

Understanding the Board of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervise the activities of an organization, which can be either a for-profit or a nonprofit organization.

It is a group of officials who the shareholders of a firm elect, As such, the board needs to ensure organizational efficiency to allow profit maximization, which will add to the shareholders’ wealth.

In general, the board makes decisions as a fiduciary on behalf of shareholders. Issues that fall under a board’s purview include the hiring and firing of senior executives, dividend policies, options policies, and executive compensation.

In addition to those duties, a board of directors is responsible for helping a corporation set broad goals, supporting executive responsibilities, and ensuring the company has adequate, well-managed resources at its disposal.

Inside Directors

An inside director is a director who may also be an employee, officer, chief executive, major shareholder or someone similarly connected to the organization. Inside directors represent the interests of the entity’s stakeholders, and often have special knowledge of its inner workings, its financial or market position, and so on.

Typical inside directors are:

- A chief executive officer (CEO) who may also be chairman of the board

- Other executives of the organization, such as its chief financial officer (CFO) or executive vice president

- Large shareholders or representatives of other stakeholders such as labor unions, major lenders, or members of the community in which the organization is located

Outside Directors

- An outside director is a member of the board who is not otherwise employed by or engaged with the organization and does not represent any of its stakeholders. A typical example is a director who is chairperson of a different company. Outside directors are not employees of the company or affiliated with it in any other way.

- Outside directors bring outside experience and perspectives to the board. For example, for a company that serves a domestic market only, the presence of CEOs from global multinational corporations as outside directors can help to provide insights on export and import opportunities and international trade options.

- Apart from the above, outside directors are often thought to be advantageous because they can be objective and present little risk of conflict of interest. As such they present their views to other board members without bias or favour.

Role of TSO vis-à-vis Outside Directors

- TSO gives you the option of a group of experienced professionals (Experts) who play the role as advisors. This option is provided by making these professionals available to the company through the website. The services are available on a 24 x 7 basis to the company

- The coordinator of TSO will interact with the company as a ‘virtual’ board member either through a professional contract; however, there is also an option for appointment under the provisions of Companies Act, 2013. While the interactions with the company will be mainly ‘virtual’, there may be some provision for ‘physical’ participation in exceptional cases

- The role fulfilled by TSO as a ‘virtual’ board member together with the expert team (who will be virtual advisors) brings outside experience and perspectives to the board. The arrangement is exceptionally advantageous since it provides independence, objectivity and avoids conflict of interest.

Private Limited Companies

- A private limited company is one whose ownership is private and whose shares are not traded on public exchanges. Typically, these companies may or may not have a functional ‘BOD’ either due to limitation of size or ownership. Appointment of a board member is done by the board itself in such companies.

- While existence of a professional ‘BOD’ does not necessarily have a bearing on the manner in which the private corporation of company is run, in many cases role of ‘professional outsiders’ is an opportunity which can make a difference to the company’s fortunes

- Another characteristic is that in India, many private companies may belong to MSME category (Micro,Small & Medium Enterprises). Whose investment ranges from Rs 1 to 5 Cr and whose turnover ranges between Rs 5 to 100 Cr

Role of TSO vis-à-vis Private Companies

- TSO offers the private limited company, whether or not a MSME, an option to enlarge its ‘think tank’ by using services of vBOD .(virtual Board of Directors) since technology today provides tools for overcoming limitation of size or ownership and enables outward looking by the private limited company or MSME.

- Our proposition is simple viz. to provide best-in-class advice & opinions from ‘professional outsiders’ who are experts in the specific domains, to all MSME’s on a pan-India basis through participation in the board on a ‘virtual’ basis.

- The USP of the website is timely & expert solutions at an affordable price while ensuring privacy, confidentiality and above all, objectivity. Also, there is no one-size-fits-all approach and we believe each customer is an unique entity demanding original solutions

Structure of Board of Directors

The composition of the board may vary as per the company and state laws. The board size is limited by a company specifying the minimum and maximum limit in its Articles of Association. Organizations commonly have 3 to 31 directors with a typical set up as follows:

- Chairman: The BOD votes and elects the chairperson. Usually, the company’s chief executive officer is the chairman.

- Managing Director : Is an individual elected by the company’s executive directors to manage, guide, and monitor business functioning.

- Executive Director: Such an individual takes active participation in the company’s management, business operations, sales, and finances.

- Non-Executive Director: External directors who present an objective and third-person perspective usually by charging a certain fee. In some cases, they give voice to stakeholders outside a firm.

Role of TSO vis-à-vis non-executive Directors

- The Chairman, Managing Director (or Chief Executive Officer) & the Executive Director discharge fiduciary responsibilities of the private corporation or private limited company. As such, the positions or responsibilities themselves remain integral and cannot be diluted in any form.

- TSO offers an alternative to the non executive director . Since they don’t belong to the organization and are expected to present an objective and third-person perspective, the definition fits the TSO perfectly

- Thus the coordinator essays two roles: 1. As an one-point reference for the company vis-à-vis TSO through the participation as a ‘virtual’ board member; 2. As a facilitator for the company to avail the services of the ‘experts’ through the website.

Sorry, the comment form is closed at this time.